We understand that our practice only exists to serve the interests of our clients. Our primary aim is therefore to put you, the client, at the forefront of all that we do.

Our Investment Principles

Raymond James, Nascot Wood always seeks to put our clients first. This is at the heart of everything we do

At the outset, we put great importance on seeking to determine what you want to achieve from your investments. What is their purpose and how much risk is appropriate to your circumstances? Our initial meetings will be structured to build a picture of these parameters. We discuss what you could expect to achieve and ensure that your expectations are aligned to a realistic set of outcomes.

There is no charge for an initial meeting and any future charges will be agreed before you invest.

We then use our thirty years of investment experience to create a portfolio that is bespoke to you.

You will receive a formal portfolio valuation every quarter. For discretionary clients, this is supplemented by a personal letter from the investment manager every six months. This letter is designed to summarise the performance and any changes to your portfolio. It acts as a focal point for our review meetings. These can take place at your home, your place of work or, if preferred, at our offices.

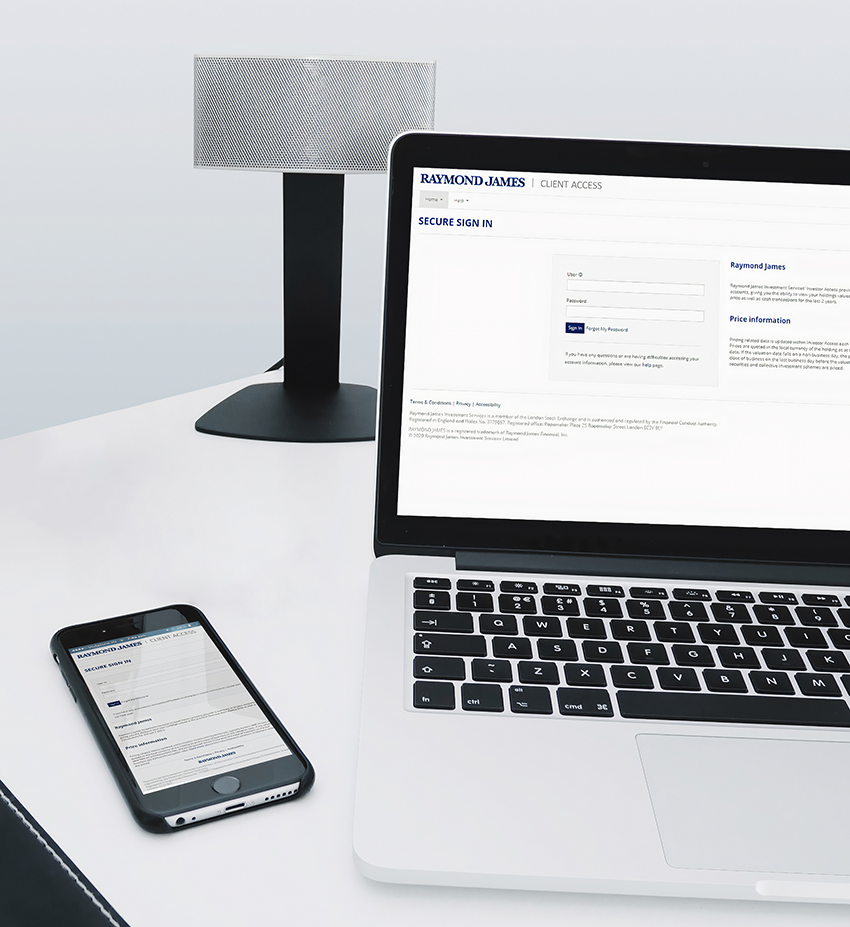

Online Account Access

You also enjoy online access via our Client Portal, Client Access. This provides you with a convenient way to access all your Raymond James accounts, placing your investment information at your fingertips.

Raymond James Client Access enables you to view your holdings, valued at the previous business day’s closing price, detailed at the account level as well as with a consolidated total where you have multiple accounts.

You are also able to view transaction information for the last two years, including any cash transactions such as buys and sells, cash dividends and cash transfers.

Client Access provides you with the most up-to-date information on your Raymond James accounts an easy-to-use format – 24 hours a day, 7 days a week – via any computer, smart phone or tablet.